Planning to buy a home in 2026? Start January strong with these 5 essential financial habits. Boost your credit, master your DTI, and get expert advice from Nexmove.

5 Financial Habits to Adopt in January 2026 to Buy Your Dream Home by December

It’s December 2025. You are standing at the threshold of a new year with a big resolution: You want to be holding the keys to your new front door by this time next year.

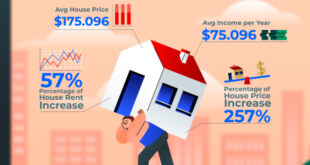

Buying a home in the current United States housing market requires more than just browsing listings; it requires a tactical financial roadmap. If you start in January, a 12-month runway is perfect to transform your financial profile from “renter” to “highly qualified buyer.”

Here is the “Answer First” Breakdown: To buy a home by December 2026, adopt these five habits immediately:

- The “Forensic” Budget Audit: Track every penny to find leakage.

- DTI Rehabilitation: Aggressively lower debt to improve your Debt-to-Income ratio.

- Credit Score Monitoring: Treat your FICO score like a fragile asset.

- The “Ghost” Savings Account: Automate transfers to a separate account you cannot touch.

- Lifestyle Inflation Freeze: Commit to living on your 2025 income, regardless of 2026 raises.

Table of Contents

Let’s dive into how to execute these effectively.

1. Conduct a “Forensic” Budget Audit (And Stick to It)

Most people think they know where their money goes. They’re usually wrong. Small, frictionless transactions—streaming subscriptions, that morning latte, the “quick” Amazon purchase—bleed budgets dry.

In January, don’t just “try to save.” You need to audit your finances like a forensic accountant.

- Download the last 3 months of bank statements. Highlight every non-essential purchase.

- Categorize ruthlessly. Distinguish between “Survival” (rent, groceries, utilities) and “Optional” (dining out, entertainment).

- The 50/30/20 Rule (Modified). Standard advice says save 20%. For a home purchase in 12 months, try to flip the script. Can you live on 50%, spend 10% on wants, and aggressively save 40%?

Pro Tip: Use cash or a debit card for “fun money” in January. When the cash is gone, the spending stops. It’s a visceral way to retrain your brain.

2. Master Your Debt-to-Income (DTI) Ratio

Lenders look at two main numbers: your credit score and your Debt-to-Income ratio (DTI). Your DTI is the percentage of your gross monthly income that goes to paying debts (credit cards, student loans, car notes).

Even with a perfect credit score, a high DTI can disqualify you from a mortgage.

The January Action Plan:

- List all debts. Order them by balance size (smallest to largest) or interest rate.

- The Snowball Method: If you need quick psychological wins, pay off the smallest balance first.

- The Avalanche Method: If you are mathematically driven, attack the highest interest rate first.

By lowering your monthly recurring debt obligations, you increase the amount a bank is willing to lend you for a mortgage.

3. Treat Your Credit Score Like Gold

Your credit score determines your interest rate. A difference of just 20 or 30 points can save (or cost) you tens of thousands of dollars over the life of a loan.

Starting in January, adopt a “Credit Defense” mindset:

- Don’t open new accounts. No new store credit cards to save 10% at the checkout counter. Every hard inquiry can temporarily dip your score.

- Keep utilization low. Try to keep your credit card balances below 10% of their limits.

- Check for errors. Go to AnnualCreditReport.com (a government-authorized site) to ensure there are no mistakes on your report.

If you are unsure where your credit stands, now is the time to find out. This preparation is part of the comprehensive guidance we advocate at nexmove.us to ensure you aren’t blindsided by a low score when you find the perfect property.

4. The “Ghost” Savings Account Strategy

The biggest hurdle for homebuyers is the down payment and closing costs. If you keep your savings in your checking account, you will accidentally spend it.

Create a “Ghost” Account:

- Open a High-Yield Savings Account (HYSA) at a different bank than your daily checking account.

- Do not order a debit card for it. Do not download the app to your phone if you lack self-control.

- Automate it. Set up a direct deposit from your paycheck to this account.

This makes the money “invisible.” You learn to live on what lands in your checking account, while your house fund grows in the background, earning interest.

5. The “No-Spend” January Challenge

Kickstart your year with a sprint. A “No-Spend” month resets your dopamine levels regarding shopping and proves to yourself that you are capable of extreme discipline.

The Rules:

- Essentials Only: Rent, utilities, basic groceries, gas/transport.

- No Eating Out: Zero. Pack your lunch every day.

- No Entertainment Spending: Find free hobbies (hiking, reading library books, board games).

Take every dollar you would have spent and dump it immediately into your “Ghost” savings account. This isn’t just about the money saved in 30 days; it’s about building the mental fortitude you’ll need for homeownership.

Why 2026 is the Year to Move

The real estate landscape is shifting. While interest rates fluctuate, the demand for quality housing in the US remains resilient. Waiting for the “perfect” market is often a trap. The best time to buy is when you are financially ready.

By sticking to these habits, you aren’t just saving money; you are building a financial resume that proves to lenders—and yourself—that you are ready to handle a mortgage.

Frequently Asked Questions

How much down payment do I really need in 2026?

While 20% is the gold standard to avoid Private Mortgage Insurance (PMI), many buyers qualify for conventional loans with as little as 3% to 5% down. However, a larger down payment usually secures a better interest rate and lower monthly payments.

Can I buy a house if I still have student loans?

Yes, absolutely. Lenders care about your DTI (Debt-to-Income) ratio. As long as your student loan payments plus your future mortgage payment don’t exceed the lender’s limits (usually around 43% of your gross income), you can qualify.

Should I pause my retirement contributions to save for a house?

This is a personal choice, but financial experts generally advise against stopping your 401(k) match. That is free money. You might consider reducing contributions above the match temporarily, but try not to sacrifice your long-term future for a short-term goal.

Final Thoughts

Buying a dream home by December 2026 isn’t about luck; it’s about consistency. The habits you form in January will compound over the next 11 months.

It won’t always be easy. There will be months where you want to splurge or skip the budget audit. But imagine next December: signing the papers, getting the keys, and walking into a home that is truly yours. That feeling is worth every sacrificed latte and every budgeting spreadsheet.

Take Your Next Step

You have the financial roadmap, now you need the market strategy. Don’t navigate the complex US housing market alone.

Whether you are looking for the perfect neighborhood or need a partner to negotiate the best deal, we are here to help. Visit nexmove.us today to start your journey toward homeownership with expert guidance.

NexMove Home & Investment Guide Find Your Perfect Property, Invest Wisely.

NexMove Home & Investment Guide Find Your Perfect Property, Invest Wisely.